Santander has just announced it will close 111 branches by August this year. The group said this morning, the closures are a result of changes in customer behaviour during the covid crisis.

Santander said branch transactions fell by 33 per cent over the two years before the pandemic and declined by a further 50 per cent in 2020. The company said that the pandemic has accelerated the shift to online banking.

Mobile and online transactions have grown by 20, it said, with almost two thirds of overall transactions now digital.

Adam Bishop at Santander, said:

“Branch usage by customers has fallen considerably over recent years so we have made the difficult decision to consolidate our presence in areas where we have multiple branches relatively close together.

The majority of the closing branches are within three miles of another branch and the furthest is five miles away. We will provide every support to customers of closing branches to find alternative ways to bank with us that best suit their individual needs.”

This is deadly serious. It’s not just Santander. Back in January, the Financial Conduct Authority (FCA) was so concerned with banks closing down branches, that it wrote to every bank in the country to ask them to reconsider.

HSBC has said it will close nearly 100 branches this year. TSB and the Co-operative Bank have also announced closures since the pandemic hit.

The FCA is worried that vulnerable and elderly customers would be left without access to financial services.

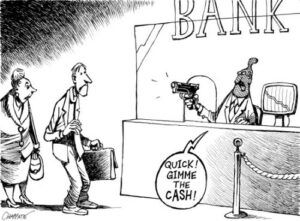

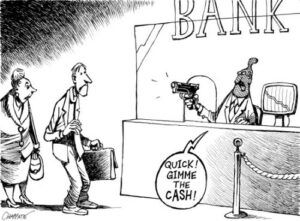

That’s not the half of it. In a cashless society every transaction you make will be traceable. Governments will be able to scrutinise every penny you spend or receive. It’s Orwellian in the extreme.

In a cashless society, governments can take your money without your permission. This is known as a bail-in. Think it unlikely? It happened in Cyprus. Look it up.

SKY News economics editor Ed Conway, writing in The Times last year, suggested the UK government could use bail-ins to pay down the massive coronavirus bill. To date, the government has borrowed over £500 billion.

Conway said the government could impose a wealth tax on every citizen and incredibly, he suggested the government could do it without warning us. He wrote; “Provided it is introduced very quickly with little warning there is scant opportunity for avoidance.”

In a cashless society, governments could penalise citizens by denying them access to their own money. This goes hand in hand with social crediting. I make a point of using cash wherever I can. You should too. Be very afraid of a cashless society.